Investment Style

CORE BELIEF:

SPEED AND PRECISION IN INVESTING

The Money Loves Speed community believes in fast decision-making, backed by rigorous research, data-driven strategies, and disciplined execution. We embrace modern factor-based investing principles,ensuring that our investment approach is systematic,evidence-based, and aligned with long-term wealth creation.

FUNDAMENTAL PILLARS OF OUR INVESTMENT PHILOSOPHY

Our investment decisions are rooted in factor-based investing, leveraging data analytics and machine learning to identify stocks with superior return potential. The core factors we focus on include:

- Quality - Companies with strong fundamentals, high return on equity (ROE), low debt, and stable earnings growth.

- Value - Stocks trading below their intrinsic value based on price-to-earnings (P/E), price-to-book (P/B),and cash flow ratios.

- Momentum - Securities exhibiting strong upward price trends, capitalizing on market psychology and buying pressure.

- Low Volatility - Stocks that demonstrate resilience during market down turns, ensuring portfolio stability.

- Multi-Factor Integration - A hybrid approach combining multiple factors for superior risk-adjusted returns.

RULE-BASED INVESTING VS. DISCRETIONARY INVESTING

While traditional investing often relies on subjective judgment, we emphasize:

- Systematic, Rule-Based Investing - Removing human bias by employing predefined investment algorithms.

- Backtested Strategies - Ensuring historical robustness of our models through rigorous testing.

- Momentum - Securities exhibiting strong upward price trends, capitalizing on market psychology and buying pressure.

- Scalability and Automation - Utilizing advanced data analytics to optimize portfolio construction.

- Multi-Factor Integration - A hybrid approach combining multiple factors for superior risk-adjusted returns.

SPEED IN EXECUTION: TACTICAL ADVANTAGE

Speed in investment decision-making is a cornerstone of our philosophy:

- Early Identification of Opportunities - Using smart beta strategies and AI-driven screening tools.

- Rapid Portfolio Rebalancing - Adjusting holdings dynamically to capitalize on market inefficiencies.

- High Liquidity Allocation - Maintaining an opportunistic cash reserve to quickly deploy capital into high-conviction ideas.

RISK MANAGEMENT: A NON-NEGOTIABLE PRINCIPLE

Risk is an inherent part of investing, but proactive risk management enhances long-term success:

- Diversification Across Factors - Removing human bias by employing predefined investment algorithms.

- Drawdown Control - Limiting losses through systematic stop-loss and hedging mechanisms.

- Stress Testing & Volatility Analysis - Continuously assessing portfolio resilience under various scenarios.

CONTINUOUS LEARNING AND ADAPTATION

- Data-Driven Insights - Regularly updating our models based on evolving market trends.

- Community - Driven Knowledge Sharing – Engaging in active discussions, research, and mentorship within the Money Loves Speed community.

- Technology Integration - Leveraging AI, machine learning, and big data for enhanced decision.

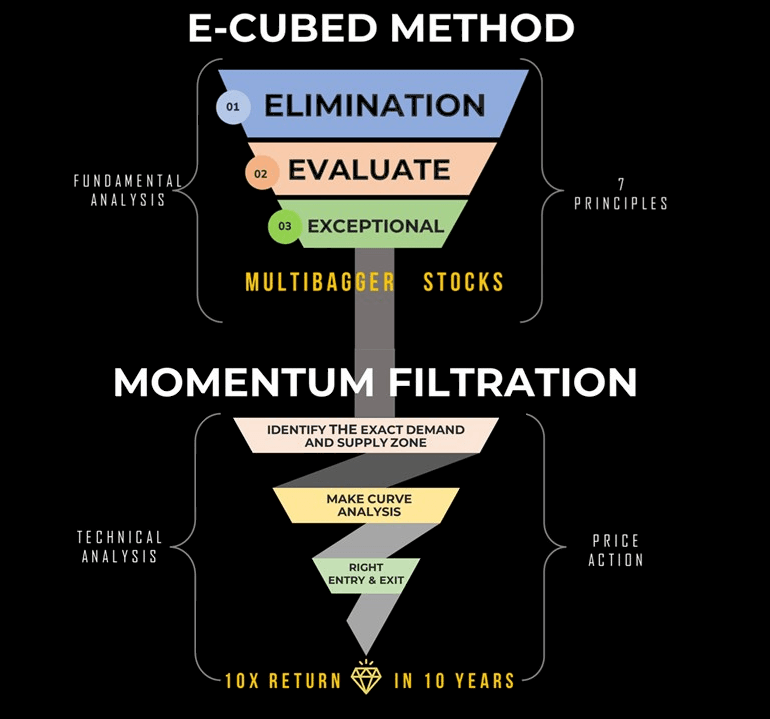

MONEY LOVES SPEED INVESTMENT STRATEGY

This strategy blends fundamental and technical analysis to identify and trade high-growth stocks efficiently.

E-Cubed Method (Fundamental Analysis) – Finding Multibaggers

- Eliminate weak companies with poor fundamentals.

- Evaluate top stocks based on 9 key principles.

- Exceptional stocks with strong growth potential are selected.

Momentum Filtration (Technical Analysis) – Timing the Market

- Identify Demand & Supply Zones for key price levels.

- Curve Analysis to confirm trends.

- Right Entry & Exit to maximize gains.